“He who spends and does not count, eats his good and does not taste it“

William Shakespeare

What is a project budget?

A project’s budget specifically determines the expenses, including their amounts and the corresponding schedule .

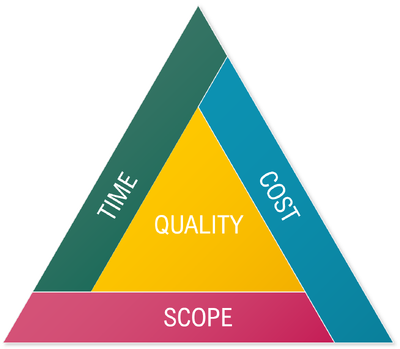

As a central element of the project’s golden triangle (cost-deadline-scope) and the quality-cost-deadline project triptych, cost is essentially monitored by the project manager, as it determines the overall profitability of the project.

Any overrun of the planned cost, for whatever reason (underestimation of costs, variations in the profiles of the stakeholders, unforeseen events in the subcontracting, etc.), has a direct impact on the budget balance and the financial performance of the project, in terms of margin or profitability.

To ensure profitability and prevent overruns, it is crucial to establish a budget plan at the beginning of the project, from the preparation and negotiation phases.

This plan clarifies the work to be done and makes it easier for stakeholders, including validators, to understand.

During the course of the project, this plan serves as a baseline to assess actual expenses against budget forecasts and project progress.

This will allow you to react quickly in the event of deviations or unforeseen events.

Agility:

Budgeting a project: a piece in 4 acts

Act 1 – Estimating Costs:

Estimating the cost of the project involves evaluating the various expenses to be expected, also known as investment items.

This includes:

- The labour cost estimate, which includes the costs of all the internal human resources required to carry out the project. This calculation is based on the Average Daily Costs (ADC) defined by profile (cost profiles)

- An estimate of the cost of the external services that the service provider will have to finance as part of the project. These can be subcontracted interventions covering manpower needs, profiles not available internally or specific expertise needs.

- Estimation of provisions, including the contingency for operational

risks

as well as the financial provision to cover any penalties incurred in connection with the commitment.

- The estimated cost of purchases includes software licenses, supplies, hardware, and room rentals. These expenses are financed directly by the project because they are specific to the project, excluding current structural costs.

- Estimation of ancillary costs such as transport, accommodation and catering costs, which will be passed on to the customer.

It is important to emphasize that these costs represent the raw material for the construction of the project budget.

Budget & Turnover

The budget consolidates all planned expenses. To obtain the sales price to the customer, it is necessary to add the applicable margins on the cost items and to deduct any commercial discounts.

This selling price is included in the turnover. It will be reflected in the accounts of the entities concerned.

But what do we mean by valorization?

The valuation of a cost corresponds to the associated turnover, as recorded in the company’s accounting.

A project can be valued based on actual expenses incurred or according to other approaches, such as the progress of the project.

Understanding Margins

A distinction should be made between the individual margin, which applies to production costs (in-house or subcontracted labour) and the project margin.

A. Individual margin:

It consists of applying a margin to each cost profile to obtain the Average Daily Rate (ADR) of each profile, representing the selling price to the customer.

For example, if Patrick is sold at an ADR of €500 while his Average Daily Cost (ADC) is €350, a margin of 30% (€150) is included in his ADR.

This margin is crucial for budgeting, especially in cases where prices are individualized (such as in management contracts or listings).

B. Project margin:

This is the overall margin of the project, calculated by subtracting the expenses from the selling price to the customer (the Turnover).

This project margin is expressed as a percentage of revenue.

For the project manager, the project margin is a key performance indicator (KPI): one of their main responsibilities is to ensure that the margin sold is not degraded throughout the project.

Example of margin calculation:

In a project involving the following expenses:

- 10 man-days of company profiles at the ADC of 350€

- 5 man-days of subcontracting, purchased at 450€

- €2,500 contingency for operational risks

- €2,000 financial provision

- 500€ transport costs

Internal profiles are sold at €650 in ADR, with an individual margin of 46.15%.

Subcontractors are sold at €800 in ADR, with an individual margin of 43.75%.

In this example, the turnover is estimated at €15,500 for expenses of €10,750.

The project margin is therefore €4,750 or 30.65% of turnover (value of the margin divided by turnover).

Start-up Margin

This project margin is established during the pre-sales process and serves as a reference. However, it is based on hypothetical cost profiles used during pre-sales, which may differ from the resources actually mobilized for the project. Thus, the project pilot adjusts the target margin based on the actual cost profiles at the beginning of the project, as they need to monitor this key indicator to assess performance.

Margin to Termination

The project manager evaluates the amount already spent to date (consumed) and realistically estimates the remaining expenses to complete the project (still to be done). The margin at completion is projected by adding the amount consumed and the forecasts, assuming that the remaining work will be carried out in accordance with the estimates. This indicator is tracked in the management tool and discussed at internal governance meetings.

Margin at Closing

Once the project is completed, the project manager re-evaluates the project margin. Lower resource utilization, unused or partially utilized provisions, and lower-than-expected expenses contribute to improved margin at closing. The comparison between the start-up and the close-out margin is used to assess the quality of the project’s management.

Leakage

Leakage is a key performance indicator (KPI) that evaluates the change in project margin. It represents the difference between the estimated mid-project completion margin and the start-up margin, as a percentage of ISO revenue. A leakage equal to or greater than 0% is required for a project to be considered profitable.

The Delivery Excellence Rate

The DE (Delivery Excellence) Rate is a KPI measuring the loss on a project, indicating that the project is no longer generating a margin and that the company is suffering a financial loss. Although it is not an indicator monitored on a daily basis by the project manager, it is important to know it, as it is monitored by the company’s finance department.

Act 2 – Draw up the budget

Once the estimated costs (as detailed in Act 1) and the total cost of the project have been determined, it is crucial to define the expenses schedule.

This is the purpose of the budget plan, which establishes when each cost will be incurred.

This plan serves as a reference to compare actual expenses to budget forecasts, thus constituting a key measure of the project’s progress and an indicator for detecting potential drifts.

Points to consider:

- The budget plan should be aligned with the billing schedule to avoid any significant discrepancies between the two.

- Its structure depends on the type of commitment and its execution methods: the management of the budget of a flat-rate project differs from that of a project under client management in Time & Material.

Act 3 – Tracking the Budget

Once the budget has been established and validated by all parties involved, it is essential to manage it throughout the project.

This is one of the main responsibilities of the project manager, who must not only ensure the profitability of the project but also seek to optimize it.

To do this, it monitors the evolution of costs (the various expenses) as well as the valued budget (the turnover recorded).

In the case of a lump sum project, these two aspects are compared to the progress of the project.

This makes it possible to monitor the budget consumption ratio (the budget already used), to check compliance with the budget plan and to anticipate future budget consumption (the budget still to be used).

Since the budget envelope is set as part of a lump sum, regular verification is required to correct or prevent discrepancies.

On the other hand, for a project under direct management, the budget valued for a given month corresponds to the production carried out during that month.

Monthly closings are therefore essential for this budget monitoring.

To ensure rigorous budget monitoring, it is also essential to ensure that purchase orders (POs) are received and that invoices are issued according to agreed contractual schedules.

This makes it possible to efficiently manage Invoices to Issue (ITI) in order to avoid any disruption to the budget.

Act 4 – Closing the Budget

At the conclusion of the project, the team in charge carries out the administrative activities and closes the contracts.

All the best practices for project closure are detailed in the page dedicated to this stage on the website.

Some definitions

Standard Cost (SC)

An employee’s Standard Cost (SC) represents their individual cost.

It includes its annual salary package (fixed and variable), the corresponding social security contributions , as well as the associated direct costs such as training, IT equipment, transport costs, etc. This cost is calculated on the basis of the number of days worked per year and a theoretical employment rate .

Standard Costs are defined by grade, which are the cost profiles used when budgeting a project.

Average Daily Cost (ADC)

Indeed, although the Standard Cost serves as a baseline for the individual cost, it differs from the Average Daily Cost (ADC) in its calculation logic.

It is incorrect to equate them. This is because, although the ADC incorporates most of the variables used to calculate the SC, it excludes the theoretical employment rate and includes indirect costs such as the cost of the workbench, pre-sales, support functions, and management costs.

Average Daily Rate (ADR)

The Average Daily Rate (ADR) represents the daily rate of a profile, i.e. the selling price offered to the customer.

For internal workers, it includes the individual cost of the profile based on the Standard Cost, to which is added the individual margin applied.

For subcontracted employees, the ADR includes the daily purchase price as well as the individual margin applied.

The ADR must meet the company’s profitability objectives while remaining competitive in the market.

0 Comments